What We Do

Financial Freedom without Boundaries.

INSTITUTIONAL MANAGEMENT

ASSET MANAGEMENT

ADVISORY

WEALTH MANAGEMENT

INVESTMENT PHILOSOPHY

Entoasset differentiated credit-focused franchise combines relative value trading with a deep understanding of fundamental credit investing and legal and structuring expertise. With an emphasis on risk management, Entoasset opportunistically invests across the capital structure in less efficient segments of the market with the goal of generating consistent, alpha-driven returns across market cycles.

Culture of transparency

We believe in sharing good (and bad) news early, aligning ourselves with our investors and companies, and truly partnering and empowering management teams. We also don’t charge transaction or monitoring fees to our portfolio companies (and haven’t since our founding)

Commitment to making companies better

We invest for the long haul to support the strategic and financial objectives of outstanding management teams. We believe our deep sector experience allows us to add value and offer insights that enable our companies to flourish.

Industry Insights

Our investment philosophy is enhanced further by the depth of our focus on industry verticals. We have distinguished ourselves as a value-added partner with deep sector insights in select verticals which enables us to take a differentiated approach to sourcing, diligence, and value creation initiatives

Demonstrated performance

We have a clear investment philosophy and disciplined approach to investing and have demonstrated performance across multiple investment cycles over our 10 years history

INVESTOR RELATIONS

Entoasset provides advanced investment strategies and wealth management solutions to forward-thinking investors around the world. Through its distinct investment brands Entoasset Management, we offers a diversity of investment approaches, encompassing bottom-up fundamental active management, Responsible Investing, systematic investing and customized implementation of client-specified portfolio exposures. Exemplary service, timely innovation and attractive returns across market cycles have been hallmarks of Entoasset since the origin.

OUR DIVERSITY & INCLUSION STRATEGY

At Entoasset, we want every person to have the opportunity to succeed based on merit, regardless of race, color, religion, creed, ancestry, national origin, sex, age, disability, marital status, citizenship status, sexual orientation, gender identity expression, military or veteran status, or any other criterion. Why is this so important? To us, diverse and inclusive teams enriched with people of distinctive backgrounds make us better. They help us generate better ideas, reach more balanced decisions, engage our communities and help our clients achieve better outcomes.

FINANCIAL PLANNING

These days, it's more important than ever to have a plan. Our version of financial planning not only gives you the confidence to know you're ready for anything, but is also designed to help you reach all your goals in the days ahead.

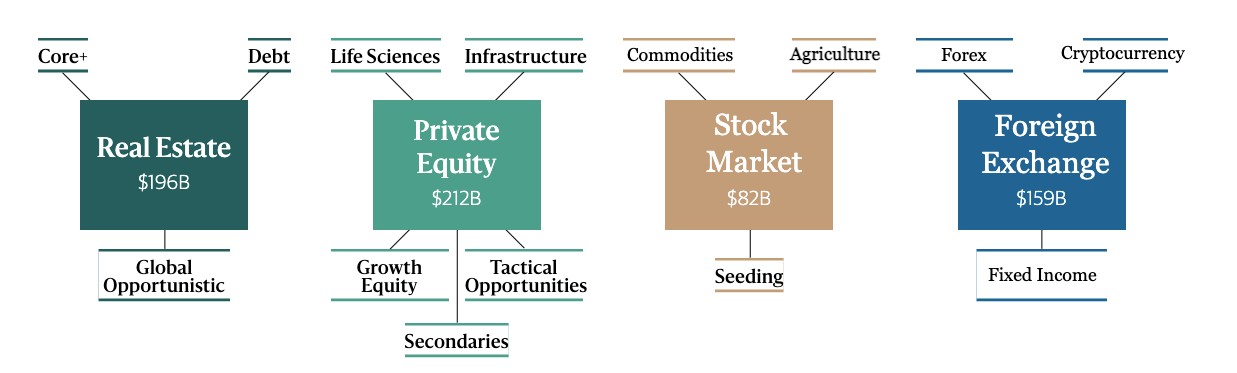

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

ENVIRONMENT

Our Buyout Funds’ portfolio can be qualified as ‘asset light’ and the most material environmental indicator for many companies is electricity usage.

SOCIAL

processes and practices are in place across the portfolio to support the wellbeing of the workforce.

GOVERNANCE

good corporate governance and a code of ethics which guides our business activities is the foundation of effective corporate management.

RESPONSIBLE INVESTING

Entoasset Partners is committed to conducting business in a safe, responsible, and ethical manner. These principals guide our decision-making throughout the investment lifecycle.

From the onset of the investment process, we pursue ideas inspired by environmental, social, and governance (‘ESG’) issues and participate in industries engaged with these themes. All companies in which we invest are first vetted by our professionals, who work closely with expert advisors, to identify and mitigate potential ESG conflicts. Our ESG due diligence program requires an assessment of ten key ESG areas which may impact the current or future performance of a company. One Equity Partners will forego any investment that fails to meet its ESG standards.

Once invested, One Equity Partners reviews and monitors all its portfolio companies to ensure they adhere to its ESG policy, which is periodically reviewed to incorporate best practices as risks evolve. This process allows One Equity Partners to quickly detect and preempt or manage any difficulties that may arise during the investment period.

As investments mature, One Equity Partners seeks to continually improve upon ESG reviews and recommendations, and, together with management, works to ensure that ESG issues are prioritized through to and beyond exit.

PROFESSIONALLY MANAGED INVESTMENT PORTFOLIOS

Time is a precious commodity. Researching investments in ever-changing markets and handling investment transactions are more than most people have time for. Venture Capital Finance's Asset Management Solutions program allows you to delegate the daily management of your assets and invest with confidence, knowing that your portfolio is in the hands of experienced professionals.

DIFFERENT GOALS REQUIRE DIFFERENT APPROACHES

At Entoasset we recognize that each investor is unique. That’s why we take a personalized approach to developing an asset management strategy by selecting investment portfolios that closely match your goals, tolerance for risk, and expectation for returns.

Our Service

SECTORS

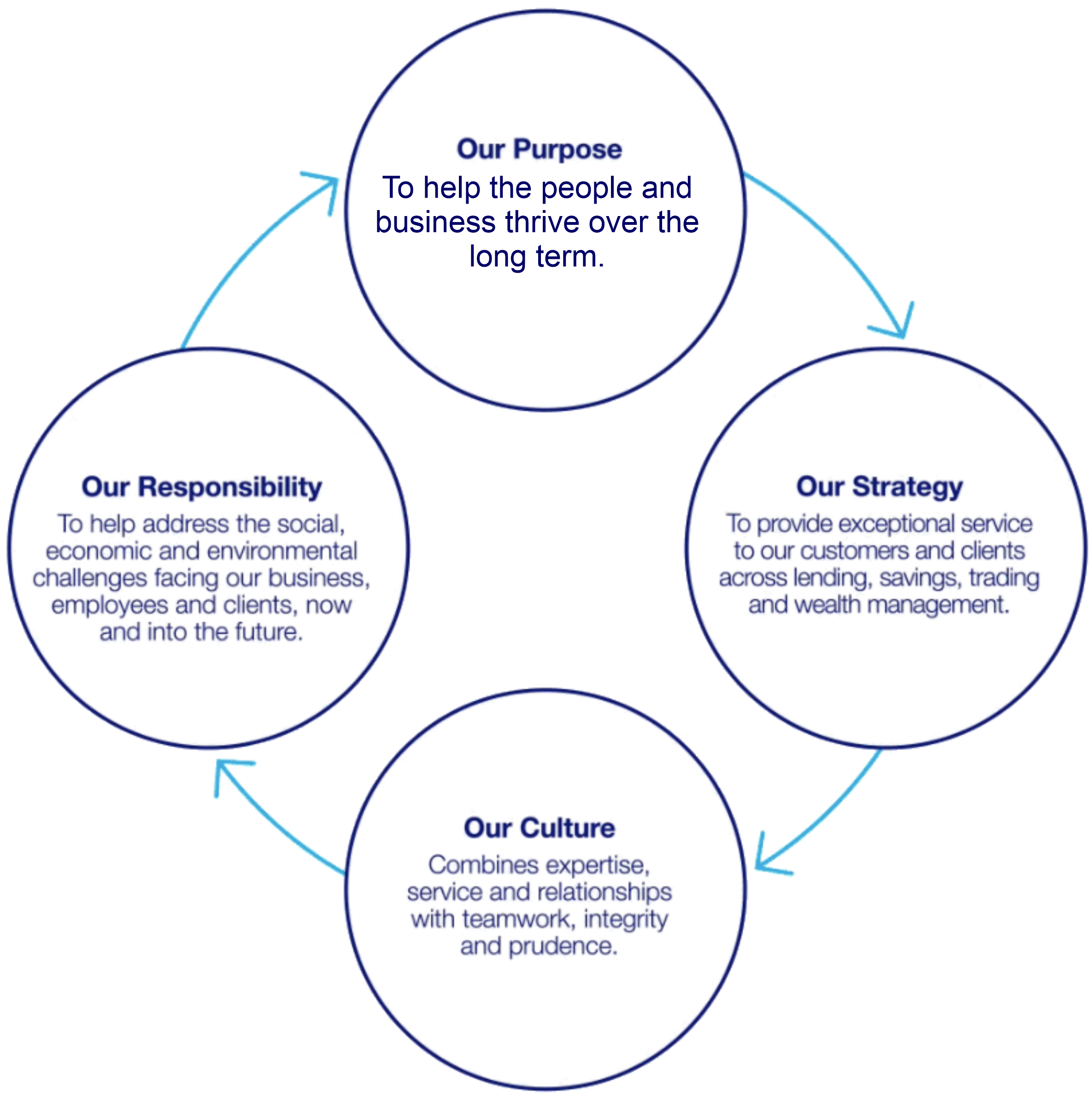

OUR PURPOSE

This means supporting our colleagues, customers and clients, and the communities and environment in which they operate, for the benefit of all our stakeholders. It means helping people and businesses unlock their potential and plan for the future with confidence, building relationships that stand the test of time. And it means that we continue to be there for the long-term, whatever the climate, making decisions that are right for today and for generations to come.

To achieve this, our long-term strategic approach place exceptional service at the heart of everything we do. Each of our diverse, specialist businesses have a deep industry knowledge, so they can understand the challenges and opportunities that our customers and clients face. We support the unique needs of our customers and clients to ensure that they thrive, rather than simply survive, whatever the market conditions.

We believe in putting our customers and clients first. Our cultural attributes bring out the very best of our people, skills and strong reputation that we have built with our stakeholders over many years. A combination of expertise, service and relationships with teamwork, integrity and prudence underpins our approach and gives us the tools to thrive over the long term.

And we recognise that to help the people and businesses of Britain thrive, we also have a responsibility to help address the social, economic and environmental challenges facing our business, employees and clients, now and into the future.

TOTAL RETURN

Diversified Growth Strategies

Offers a wide range of return sources including market risk premia, alternative risk premia, and alpha, with less of the reliance on rising prices for traditional assets that traditional diversified growth strategies can have.

Long-Short Equity

Employs our multi-factor investment process based on Entoasset's broadest global stock selection capabilities, while maintaining a consistent net long exposure to the market.

Risk Parity

Invests across global asset classes by risk allocation as opposed to capital, seeking to build a portfolio that is both broadly diversified, but not overly reliant on any single asset class.

Multi-Strategy

Offers a diversified approach to alternatives investing, seeking to provide broad exposure to several different Entoasset strategies at the same time.